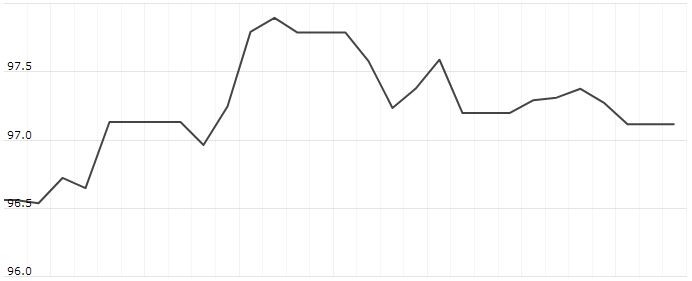

The U.S. Dollar Index is trading at 97.26 with a loss of -0.05% percent or -0.04 point. The Dow Futures is trading at 25,686.50 with a loss of -1.07% percent or -277.50 point. The S&P 500 Futures is trading at 2,853.88 with a loss of -1.15% percent or -33.12 point. The Nasdaq Futures is trading at 7,492.50 with a loss of -1.55% percent or -117.75 point.

TODAY’S FACTORS AND EVENTS

China’s yuan was set for its worst daily fall in nine months on Monday as trade negotiations between the U.S. and China ended after President Donald Trumpraised tariffs on Chinese goods.

Currency moves in response to the latest trade hostilities have been muted, but on Monday the yuan fell 0.8% to 6.9040, its weakest since Dec. 27.

Some analysts say it may breach 7 per dollar in coming months, a level last seen during the global financial crisis.

China would probably use its vast currency reserves to stop any plunge through 7 to the dollar, which could trigger speculation and heavy capital outflows.

Investors bid up the yen, which is considered a safe haven in times of stress given Japan’s status as the world’s largest creditor and its huge hoard of assets abroad.

PREVIOUS DAY ACTIVITY

For the day the FTSE 100 closed at 7,203.29 with a loss of -0.057% percent or -4.12 point. France’s CAC 40 closed at 5,327.44 up with +0.27% percent or +14.29 point. Germany’s DAX closed at 12,059.83 up with +0.72% percent or +85.91 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,572.99 up with +0.19% percent or +2.94 point; the S&P 600 Small-Cap Index closed at 964.29 up with +0.20% percent or +1.88 point; the S&P 400 Mid-Cap Index closed at 1,933.43 up with +0.30% percent or +5.69 point; the S&P 100 Index closed at 1,275.10 up with +0.31% percent or +3.88 point; the Russell 3000 Index closed at 1,699.78 up with +0.35% percent or +5.90 point; the Russell 1000 Index closed at 1,597.05 up with +0.36% or +5.74 point.