U.S INDEX MARKET

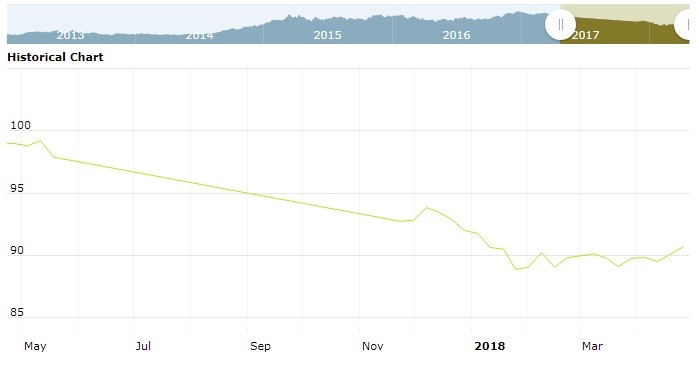

The U.S. Dollar Index is trading at 90.91 with a loss of -0.02% percent or -0.02 point. The Dow Futures is trading at 24,459.00 up with +0.18% percent or +45.00 point. The S&P 500 Futures is trading at 2,676.25 up with +0.19% percent or +5.00 point. The Nasdaq Futures is trading at 6,675.50 up with +0.13% percent or +8.50 point.

TODAY’S FACTORS AND EVENTS

The dollar set a three-month high against a basket of currencies on Tuesday, having gained a boost as the U.S. 10-year Treasury yield climbed toward the psychologically key 3 percent level.

The U.S. 10-year Treasury yield hit its highest in over four years at 2.998 percent on Monday, driven by worries about the growing supply of government debt and inflationary pressures from rising oil prices.

The U.S. 10-year bond yield later backed off that level a bit and stood at 2.971 percent in Tuesday’s early Asian trade.

Including Monday’s move, the U.S. 10-year yield surged nearly 16 basis points in four trading sessions, the biggest four-day rise since late June last year.

The rise in Treasury yields has caused U.S.-Japan and U.S.-German yield differentials to widen in the dollar’s favour, leaving the yen and the euro lower.

PREVIOUS DAY ACTIVITY

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,562.12 with a loss of -0.13% percent or -2.00 point; the S&P 600 Small-Cap Index closed at 961.77 up with +0.0010% percent or +0.010 point; the S&P 400 Mid-Cap Index closed at 1,900.96 up with +0.024% percent or +0.46 point; the S&P 100 Index closed at 1,170.43 with a loss of -0.0017% percent or −0.020 point; the Russell 3000 Index closed at 1,584.05 with a loss of -0.021% percent or −0.33 point; the Russell 1000 Index closed at 1,481.00 with a loss of -0.012% percent or −0.18 point;