US PRE MARKET

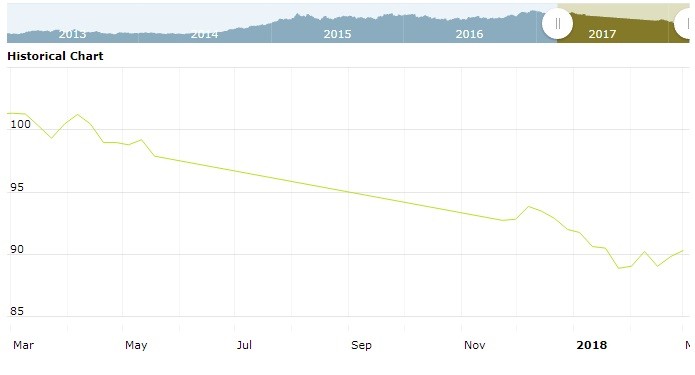

The US Dollar Index are trading at 90.64 with 0.00% percent or 0.00 point. The cac 40 index are trading at 5,292.74 with a loss of -0.52% percent or -27.75 point . The DAX Index are trading at 12,342.26 with a loss of -0.75% percent or -93.59 point. The EURO Stoxx 50 Index are trading at 3,425.60 with a loss of -0.39% percent or -13.36 point.

TODAY’S FACTORS AND EVENTS

The dollar held firm on Thursday, drawing support after the Federal Reserve’s new chief Jerome Powell struck an optimistic tone on the U.S. economy in a boost to rate hawks that sent global stocks tumbling.

In contrast, benign inflation data in the euro zone dented expectations that the European Central Bank will dial back its stimulus, slamming the euro to five-week lows against the dollar and a six-month nadir against the yen.

The dollar index rose to a five-week high of 90.746, as Powell’s optimism on the U.S. economy suggested the Fed is going to raise interest rates four times this year, one more than what markets had expected.

PREVIOUS DAY ACTIVITY

U.S. market were lower on Wednesday. For the day the Dow Jones Industrial Average closed at 25,029.20 with a loss of -1.50% percent or -380.83 point. The S&P 500 closed at 2,713.83 with a loss of -1.11% percent or -30.45 point. The Nasdaq Composite closed at 7,273.01 with a loss of -0.78% percent or -57.35 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,512.45 with a loss of -1.56% percent or -24.03 point; the S&P 600 Small-Cap Index closed at 921.34 with a loss of -1.76% percent or -16.49 point; the S&P 400 Mid-Cap Index closed at 1,864.61 with a loss of -1.20% percent or -22.60 point; the S&P 100 Index closed at 1,201.87 with a loss of -1.19% percent or -14.44 point; the Russell 3000 Index closed at 1,600.15 with a loss of -1.11% percent or – 17.94 point; the Russell 1000 Index closed at 1,501.23 with a loss of -1.07% percent or -16.28 point; and the Dow Jones U.S. Select Dividend Index closed at 25,029.20 with a loss of -1.50% percent or -380.83 point.