US PRE MARKET

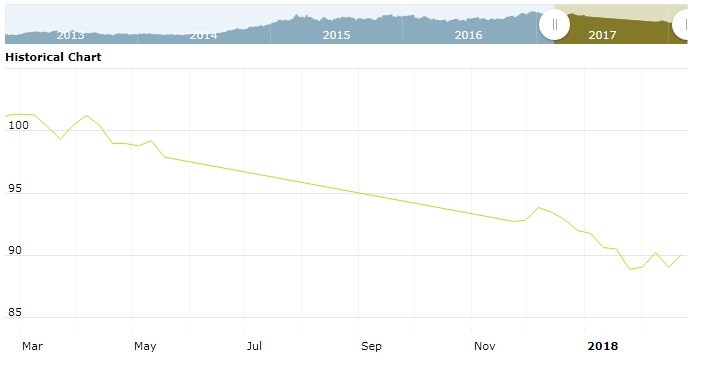

The US Dollar Index are trading at 90.15 for up with +0.03% percent or +0.04 point. The cac 40 index are trading at 5,274.66 with a loss of -0.52% percent or -27.51 point . The DAX Index are trading at 12,384.12 with a loss of -0.69% percent or -86.37 point. The EURO Stoxx 50 Index are trading at 3,412.13 with a loss of -0.53% percent or -18.03 point.

TODAY’S FACTORS AND EVENTS

The dollar traded near a one-week high against a basket of major currencies on Thursday, rising after minutes of the Federal Reserve’s January meeting showed policymakers were more confident of the need to keep raising interest rates.

The dollar index last stood at 90.117, after reaching a high of 90.166, its highest level since Feb. 13. That marked a gain of about 2.2 percent from a three-year low near 88.25, set last week.

A more upbeat take on inflation in the minutes of the Fed’s Jan. 30-31 policy meeting bolstered expectations for rate hikes. U.S. short-term interest-rate futures continued to reflect firm expectations that the Fed will raise rates three times this year.

PREVIOUS DAY ACTIVITY

U.S. market were lower on Wednesday. For the day the Dow Jones Industrial Average closed at 24,797.78 with a loss of -0.67% percent or -166.97 point. The S&P 500 closed at 2,701.33 with a loss of -0.55% percent or -14.93 point. The Nasdaq Composite closed at 7,218.23 with a loss of -0.22% percent or -16.08 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,531.84 for up with +0.12% percent or +1.84 point; the S&P 600 Small-Cap Index closed at 934.93 for up with +0.21% percent or +1.99 point; the S&P 400 Mid-Cap Index closed at 1,884.04 with a loss of -0.22% percent or – 4.23 point; the S&P 100 Index closed at 1,194.38 with a loss of -0.53% percent or -6.33 point; the Russell 3000 Index closed at 1,596.33 with a loss of -0.48% percent or -7.66 point; the Russell 1000 Index closed at 1,495.84 with a loss of -0.53% percent or -7.90 point; and the Dow Jones U.S. Select Dividend Index closed at 24,797.78 with a loss of -0.67% percent or -166.97 point.