US PRE MARKET

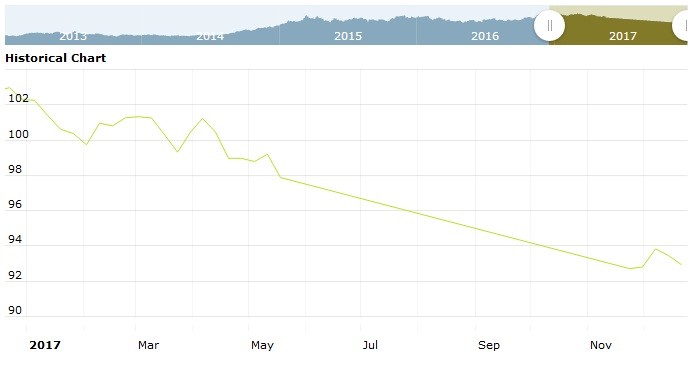

The US Dollar Index are trading at 93.38 for up with +0.09% percent or +0.09 point. The cac 40 index are trading at 5,370.83 with a loss of -0.29% percent or –15.43 point . The DAX Index are trading at 13,093.71 with a loss of –0.12% percent or –16.03 point. The EURO Stoxx 50 Index are trading at 3,558.09 with a loss of –0.36% percent or –12.69 point.

TODAY’S FACTORS AND EVENTS

The dollar edged higher on Thursday after two days of losses in light trading, lifted by generally positive U.S. data and a tax overhaul plan that could prompt the Federal Reserve to raise interest rates at a faster-than-expected pace.

Still, the U.S. currency was on track to post its worst yearly performance in 14 years. That said, the medium-term outlook for the dollar has turned a little more positive than what many on Wall Street had priced in, with expected rate hikes from the Fed next year and, at the very least, modest benefits from the U.S. tax program.

PREVIOUS DAY ACTIVITY

U.S. market were higher on Thursday. For the day the Dow Jones Industrial Average closed at 24,782.29 for up with +0.23% percent or +55.64 point. The S&P 500 closed at 2,684.57 for up with +0.20% percent or +5.32 point. The Nasdaq Composite closed at 6,965.36 for up with +0.06% percent or +4.40 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,547.11 for up with +0.46% percent or +7.03 point; the S&P 600 Small-Cap Index closed at 942.16 for up with +0.42% percent or +3.96 point; the S&P 400 Mid-Cap Index closed at 1,905.18 for up with +0.27% percent or +5.22 point; the S&P 100 Index closed at 1,190.39 for up with +0.32% percent or +3.82 point; the Russell 3000 Index closed at 1,589.03 for up with +0.23% percent or +3.61 point; the Russell 1000 Index closed at 1,487.23 for up with +0.21% percent or +3.10 point; and the Dow Jones U.S. Select Dividend Index closed at 24,782.29 for up with +0.23% percent or +55.64 point.