US PRE MARKET

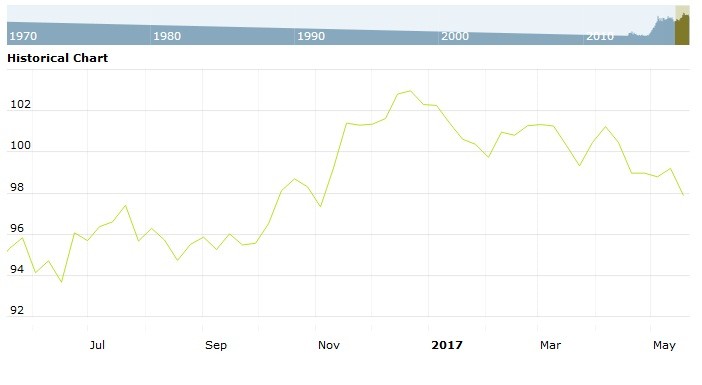

The US Dollar Index are trading at 93.66 with a loss of -0.27% percent or -0.25 point. The cac 40 index are trading at 5,322.74 with a loss of –0.26% percent or –13.65 point . The DAX Index are trading at 13,022.00 with a loss of –0.19% percent or –25.22 point. The EURO Stoxx 50 Index are trading at 3,552.45 with a loss of –0.35% percent or –12.35 point.

TODAY’S FACTORS AND EVENTS

The dollar steadied on Friday after coming off the week’s lows against its peers as earlier risk aversion in global financial markets receded, pushing up U.S. yields.

The dollar index against a basket of six major currencies was little changed at 93.822.

The index had edged up overnight to pull away from a four-week trough of 93.402 set on Wednesday. Wall Street shares rallied overnight after sagging through much of the week, causing a 4 basis points jump in the long-term Treasury yield to shore up the dollar.

PREVIOUS DAY ACTIVITY

U.S. market were higher on Thursday. For the day the Dow Jones Industrial Average closed at 23,458.36 for up with +0.80% percent or +187.08 point. The S&P 500 closed at 2,585.64 for up with +0.82% percent or +21.02 point. The Nasdaq Composite closed at 6,793.29 for up with +1.30% percent or +87.08 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,486.88 for up with +1.56% percent or +22.79 point; the S&P 600 Small-Cap Index closed at 905.23 for up with +1.72% percent or +15.29 point; the S&P 400 Mid-Cap Index closed at 1,836.39 for up with +1.01%percent or +18.34 point; the S&P 100 Index closed at 1,139.91 for up with +0.81%percent or +9.17 point; the Russell 3000 Index closed at 1,530.53 for up with +0.89% percent or +13.44 point; the Russell 1000 Index closed at 1,432.75 for up with +0.83% percent or +11.82 point; and the Dow Jones U.S. Select Dividend Index closed at 23,458.36 for up with +0.80% percent or +187.08 point.