US PRE MARKET

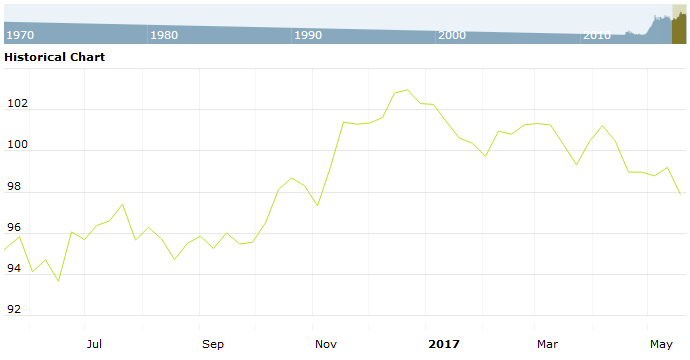

The US Dollar Index are trading at 93.46 for up with +0.20% percent or +0.19 point. The cac 40 index are trading at 5,359.93 with a loss f –0.05% percent or –2.94 point . The DAX Index are trading at 13,005.44 for up with +0.01% percent or +1.74 point. The EURO Stoxx 50 Index are trading at 3,607.09 for up with +0.02% percent or +0.82 point

TODAY’S FACTORS AND EVENTS

The dollar held to gains against the yen and euro on Tuesday, supported by a rise in Treasury yields following a report that U.S. President Donald Trump was favoring a policy hawk as the next head of the Federal Reserve.

Treasury yields bounced from two-week lows and rose on Monday after a report that President Trump was favoring Stanford economist John Taylor, seen as more hawkish than current Chair Janet Yellen, to head the Fed.

“The dollar was under pressure as Treasury yields declined last week. But it was allowed to rebound as a stronger Wall Street, good U.S. data and the report about Taylor all came into place to stop the yield decline,” said Junichi Ishikawa, senior forex strategist at IG Securities in Tokyo.

PREVIOUS DAY ACTIVITY

U.S. market were higher on Monday. For the day the Dow Jones Industrial Average closed at 22,956.96 for up with +0.37% percent or +85.24 point. The S&P 500 closed at 2,557.64 for up with +0.18% percent or +4.47 point. The Nasdaq Composite closed at 6,624.00 for up with +0.28% percent or +18.20 point.

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,502.68 with 0.00% percent or +0.02 point; the S&P 600 Small-Cap Index closed at 908.14 with a loss of –0.03% percent or –0.23 point; the S&P 400 Mid-Cap Index closed at 1,819.46 for up with +0.04% percent or +0.64 point; the S&P 100 Index closed at 1,129.29 for up with +0.28% percent or +3.13 point; the Russell 3000 Index closed at 1,517.15 for up with +0.15% percent or +2.26 point; the Russell 1000 Index closed at 1,417.95 for up with +0.16% percent or +2.28 point; and the Dow Jones U.S. Select Dividend Index closed at 22,956.96 for up with +0.37% percent or +85.24 point.