At first sight, nothing changed much in the levels the Dollar Index has been trading in throughout the passing week. We even had a HH HL Weekly bar.

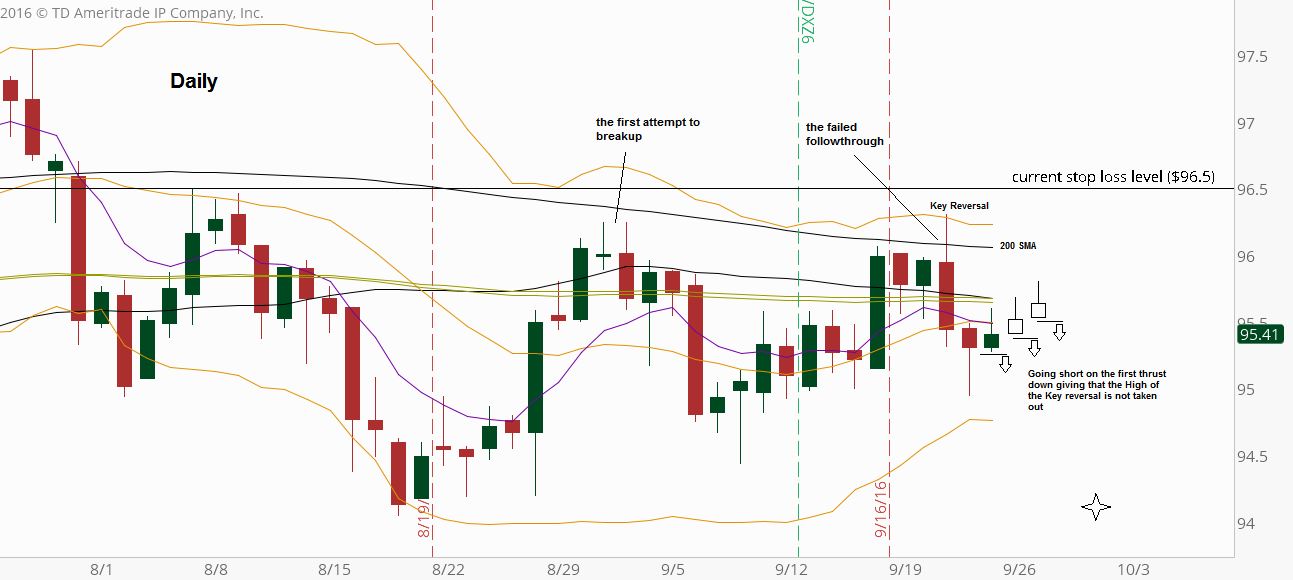

The Daily bars of the passing week tell a different story. The upthrust made on last Wednesday is an important Daily bar. This was an attempt to make a follow through for the last Highs that had been made on August 31th and September 1st. The attempt to go higher has failed to reach the Weekly 50 SMA, and turned into a big bearish Key Reversal bar (the previous two Daily bars were inside bars so they are not counted). This bearish KR was confirmed right away on the following day, meaning eventually, a false break up.

The first Daily LL that is going to be made the coming week, given that the Weekly High still remains respected is a very good bearish signal to reach the 94.19 level at least.

The coming week is the last week of the Month and Quarter. So far the Monthly bar has been an inside bar, and by most chances it is going to close as an inside bar. Closing the Weekly bar above the 96 level is very questionable for the midterm bearish idea.

Again, as mentioned throughout the last reviews, we should be aware of the most important indications around alarming of signs of strength: the Daily 200 SMA and the Weekly 50 SMA. The current stop level for the midterm bearish ideas is still at 96.5.

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.