The passing week didn’t bring any important indication as for the next midterm move of the Dollar Index. Currently the price is within the previous Month’s range.

Closing the passing week below the 8 EMA short term sentiment line was bearish, but the fact that the market didn’t manage to take out an important Low such as 94.2, not to mention the Monthly Low at 94.05 over the passing week was a sign of strength. This shouldn’t be a surprise, as the Daily bar of August 26th made an important thrust up, and it is natural to see strong support the first time the price approaches back into these levels. Looking more backward, all the area of 93.5 till 94 is an area of support because of the same reason, and for any midterm bearish position it needs a lot of patience to see the bearish process developing eventually.

Remember that for any timeframe (in this case the Daily), where the current behavior on higher timeframes is not so clear, the mid range area is the most random place in terms of price action behavior – for that specific timeframe (it doesn’t mean though that on lower timeframe the situation will be random ! it can be very clear, but with the boundaries and time limit of that smaller timeframe).

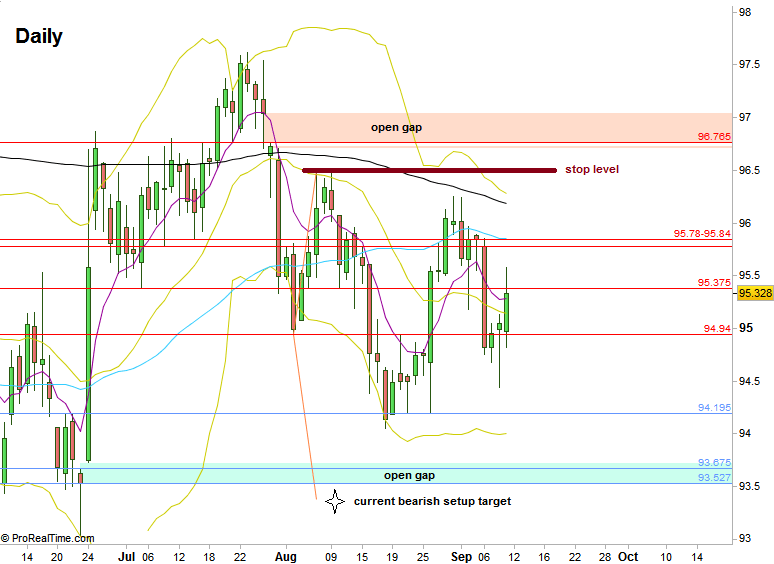

The most important spot for the midterm is still the Monthly High, at 96.5. As mentioned previously, taking out this High should cancel any midterm bearish idea, while on the other hand, it doesn’t mean being bullish midterm neither.

The current bearish setup is still pointing at 93.5 as a target, which means closing the open gap since June 23rd (prior to the Brexit news), but not taking out the near Low of 93.025. The stop is 96.5 as mentioned before.

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.