DailyFX.com –

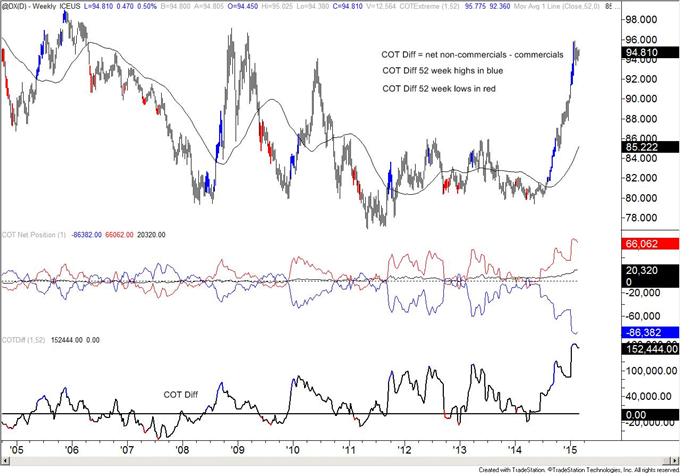

- US Dollar Index small trader record longs…again!

- Large traders continue to cover Yen shorts

- Crude small traders flip to net short position

View COT data in MT4

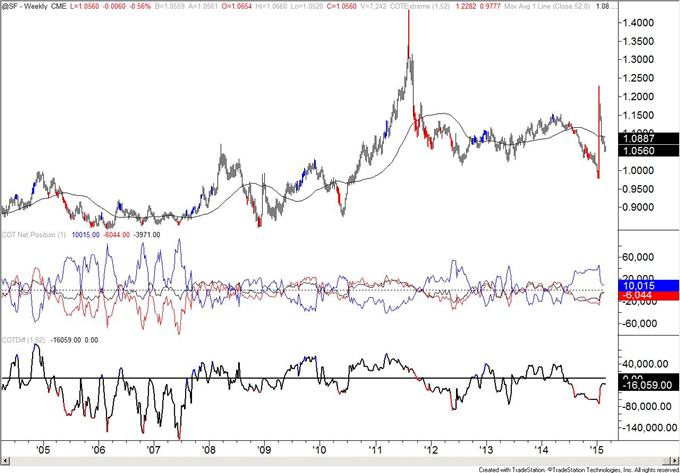

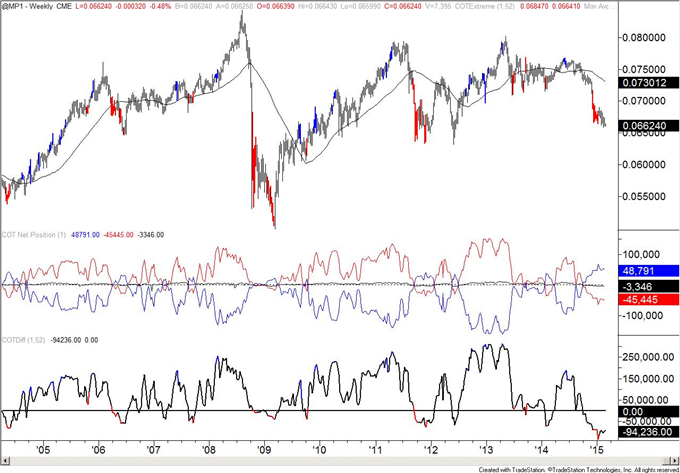

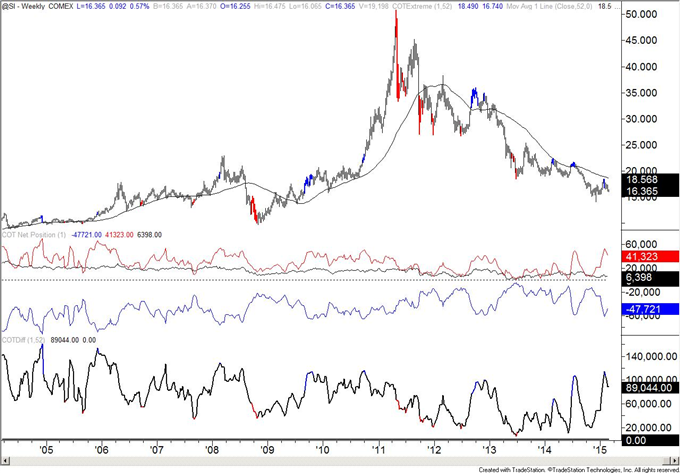

Latest CFTC Release dated February 17, 2014:

The COT Index is the difference between net speculative positioning and net commercial positioning measured. A blue colored bar indicates that the difference in positioning is the greatest it has been in 52 weeks (bullish) with speculators selling and commercials buying. A red colored bar indicates that the difference in positioning is the greatest it has been in 52 weeks (bearish) with speculators buying and commercials selling. Non commercials tend to be on the wrong side at the turn and commercials the correct side. Use of the index is covered closely in detail in my book.

Charts (all charts are continuous contract)

Non Commercials (speculators) – Red

Commercials – Blue

Small Speculators – Black

COTDiff (COT Index) – Black

US Dollar

Chart prepared by Jamie Saettele, CMT

Euro

Chart prepared by Jamie Saettele, CMT

British Pound

Chart prepared by Jamie Saettele, CMT

Australian Dollar

Chart prepared by Jamie Saettele, CMT

Japanese Yen

Chart prepared by Jamie Saettele, CMT

Canadian Dollar

Chart prepared by Jamie Saettele, CMT

Swiss Franc

Chart prepared by Jamie Saettele, CMT

Mexican Peso

Chart prepared by Jamie Saettele, CMT

Gold

Chart prepared by Jamie Saettele, CMT

Silver

Chart prepared by Jamie Saettele, CMT

Copper

Chart prepared by Jamie Saettele, CMT

Crude

Chart prepared by Jamie Saettele, CMT

— Written by Jamie Saettele, CMT, Senior Technical Strategist for DailyFX.com

To contact Jamie e-mail jsaettele@dailyfx.com. Follow me on Twitter for real time updates @JamieSaettele

Jamie is the author of

Learn forex trading with a free practice account and trading charts from FXCM.- Finance

- Currency