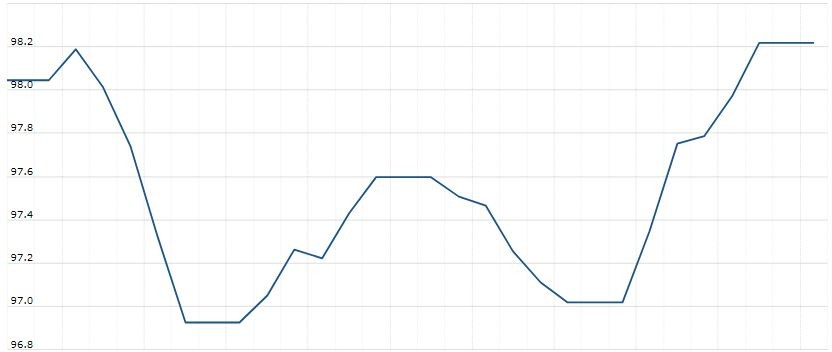

The U.S. Dollar Index is trading at 98.39 up with +0.01% percent or +0.01 point. The Dow Futures is trading at 27,707.50 with a loss of -0.19% percent or -53.50 point. The S&P 500 Futures is trading at 3,089.62 with a loss of -0.19% percent or -5.88 point. The Nasdaq Futures is trading at 8,249.12 with a loss of -0.20% percent or -16.63 point.

TODAY’S FACTORS AND EVENTS

The U.S. dollar was stable on Thursday after October consumer price inflation was greater than expected and Federal Reserve Chair Jerome Powell offered an optimistic outlook for the economy, further solidifying the case for the central bank to pause its monetary easing cycle.

Expectations for an interest rate cut do not rise above 30% before July 2020, according to CME Group’s FedWatch tool. And the slim chances of a cut in the months prior on Wednesday became slimmer.

U.S. consumer prices jumped by the most in seven months in October, a report from the Labor Department on Wednesday showed, as the cost of healthcare surged by the most in more than three years. The Fed uses interest rate hikes to rein in inflation, making a near-term cut slightly less likely.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 27,783.59 up with +0.33% percent or +92.10 point. The S&P 500 is trading at 3,094.04 up with +0.071% percent or +2.20 point. The Nasdaq Composite is trading at 8,482.10 with a loss of –0.047% percent or –3.99 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,589.18 with a loss of –0.37% percent or -5.94 point; the S&P 600 Small-Cap Index closed at 979.62 with a loss of -0.59% percent or -5.85 point; the S&P 400 Mid-Cap Index closed at 1,986.46 with a loss of –0.23% percent or -4.53 point; the S&P 100 Index closed at 1,378.84 up with +0.017% percent or +0.23 point; the Russell 3000 Index closed at 1,811.76 up with +0.039% percent or +0.71 point; the Russell 1000 Index closed at 1,708.94 up with +0.12% or +2.12 point.