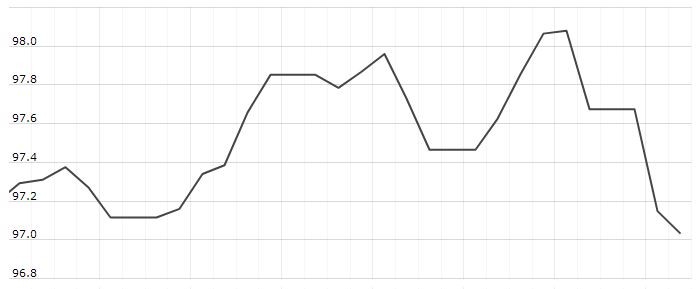

The U.S. Dollar Index is trading at 97.05 with a loss of -0.01% percent or –0.00 point. The Dow Futures is trading at 25,519.50 up with +0.68% percent or +173.50 point. The S&P 500 Futures is trading at 2,824.38 up up with +0.69% percent or +19.38 point. The Nasdaq Futures is trading at 7,241.25 up with +0.86% percent or +62.00 point.

TODAY’S FACTORS AND EVENTS

The dollar struggled near seven-week lows on Wednesday after U.S. central bank officials hinted at the possibility of an interest rate cut in the face of rising risks to trade and global growth.

Federal Reserve Chairman Jerome Powell dropped his standard reference to the Fed being “patient” in approaching any rate decision on Tuesday, saying instead the central bank will respond as “as appropriate” to trade pressure.

The dollar index against a basket of six peers was last flat at 97.077, within reach of a recent low of 96.995 brushed overnight – its lowest since April 18. It has now fallen 1.3% from a more than two-year high of 98.371 touched on May 23.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 25,332.18 up with +2.06% percent or +512.40 point. The S&P 500 is trading at 2,803.27 up with +2.14% percent or +58.82 point. The Nasdaq Composite is trading at 7,527.12 up with +2.65% percent or +194.10 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,508.56 up with +2.62% percent or +38.58 point; the S&P 600 Small-Cap Index closed at 918.89 up with +2.72% percent or +24.37 point; the S&P 400 Mid-Cap Index closed at 1,868.82 up with +2.52% percent or +45.88 point; the S&P 100 Index closed at 1,232.95 up with +2.16% percent or +26.12 point; the Russell 3000 Index closed at 1,651.89 up with +2.22% percent or +35.82 point; the Russell 1000 Index closed at 1,553.62 up with +2.19% or +33.23 point.