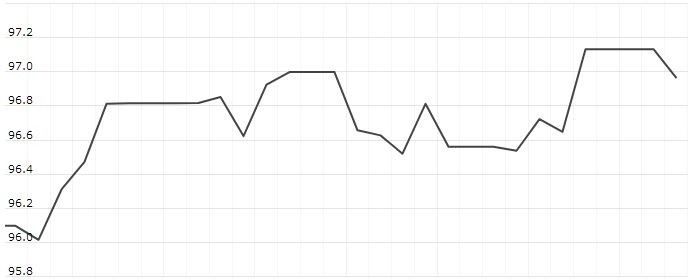

The U.S. Dollar Index is trading at 97.34 up with +0.05% percent or +0.05 point. The Dow Futures is trading at 26,496.00 with a loss of -0.06% percent or -17.00 point. The S&P 500 Futures is trading at 2,909.88 with a loss of -0.09% percent or -2.62 point. The Nasdaq Futures is trading at 7,729.12 with a loss of -0.07% percent or -5.63 point.

TODAY’S FACTORS AND EVENTS

The dollar held near three-week highs on Tuesday as a drop in market volatility ramped up demand for riskier assets.

With 10-year U.S. Treasury yields up by more than 20 basis points over the past four weeks to a one-month high, demand for U.S.-denominated assets has grown.

Broader market moves were quiet as financial markets reopened after the Easter holiday.

The dollar index against a basket of six key rivals rose to 97.39, edging toward the 2019 high of 97.71 struck in early March.

PREVIOUS DAY ACTIVITY

For the day the Dow is trading at 26,511.05 with a loss of -0.18% percent or -48.49 point. The S&P 500 is trading at 2,907.97 up with +0.10% percent or +2.94 point. The Nasdaq Composite is trading at 8,015.27 up with +0.22% percent or +17.21 point.

WORLD MARKETS

Other leading market index closes included the small-cap Russell 2000 Index closed at 1,560.04 with a loss of -0.36% percent or -5.70 point; the S&P 600 Small-Cap Index closed at 957.25 with a loss of -0.56% percent or -5.41 point; the S&P 400 Mid-Cap Index closed at 1,946.21 with a loss of -0.37% percent or -7.22 point; the S&P 100 Index closed at 1,290.69 up with +0.26% percent or +3.29 point; the Russell 3000 Index closed at 1,711.87 up with +0.052% percent or +0.89 point; the Russell 1000 Index closed at 1,610.27 up with +0.084% or +1.34 point.