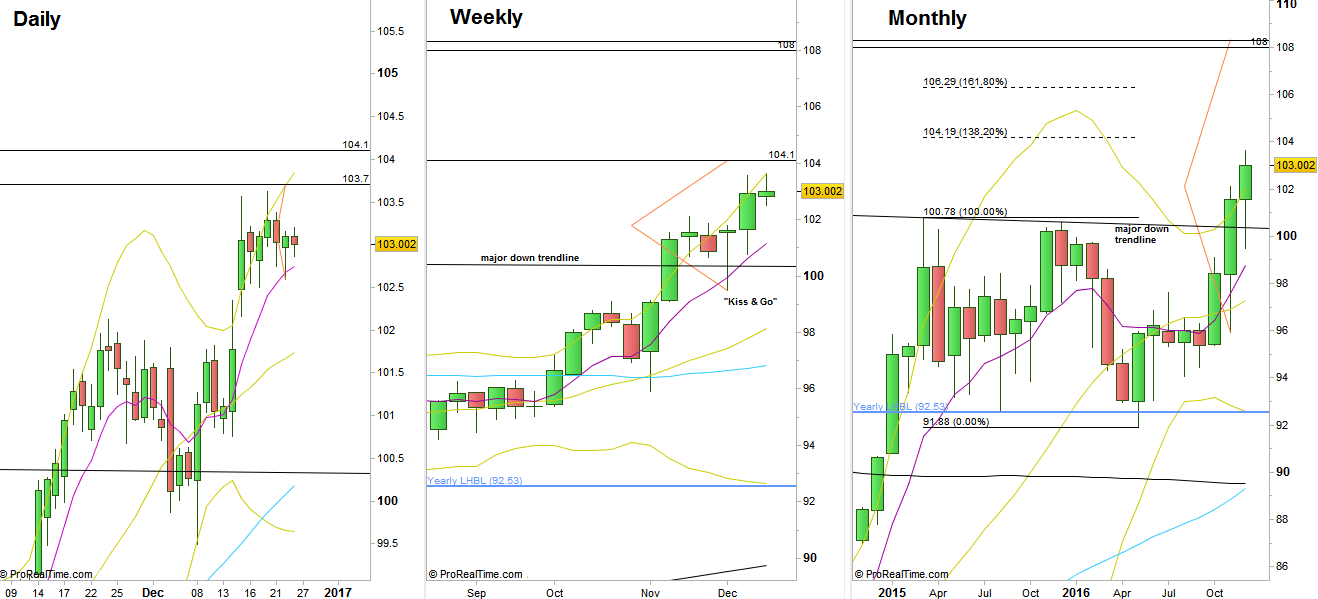

A relatively narrow range Weekly bar has been printed before the holiday, but still a HH HL bar touching the upper Bollinger band, meaning that the momentum is still very strong, and nothing has changed much as for the nearest targets.

Currently there is a bullish signal on the Daily timeframe, last Thursday’s bullish pinbar on sloping 8 EMA – already got a confirmation by the thrust up made last Friday. The target is at 103.7.

On the other hand, any pullback down that doesn’t close the open gap below at 101.77-102.16, followed by signs of strength is a very good signal to continue higher. In this case, the nearest swing target is the 104.1 area that the bullish Weekly pinbar on sloping 8 EMA 3 weeks ago is targeting to. This Weekly bullish pinbar tested the major down trendline above the whole price action since March 2015, in a “Kiss and Go” manner. Slightly above, at 104.19 there is the 138.2% extension for the whole bearish activity since March 2015. The 161.8% extension for that retracement lies at 106.29.

Above that target, the next major target is the previous Semiannual bullish pinbar on sloping 8 EMA pointing towards 108, slightly below the target of the Bullish Monthly bar of last November on sloping 8 EMA pointing at 108.3.

I wouldn’t recommend holding the same position for the higher targets than 104.1, as by the Yearly charts there are very good chances to see a considerable retracement below the stop level of that Weekly bullish pinbar, before the bigger move most likely continues.

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.