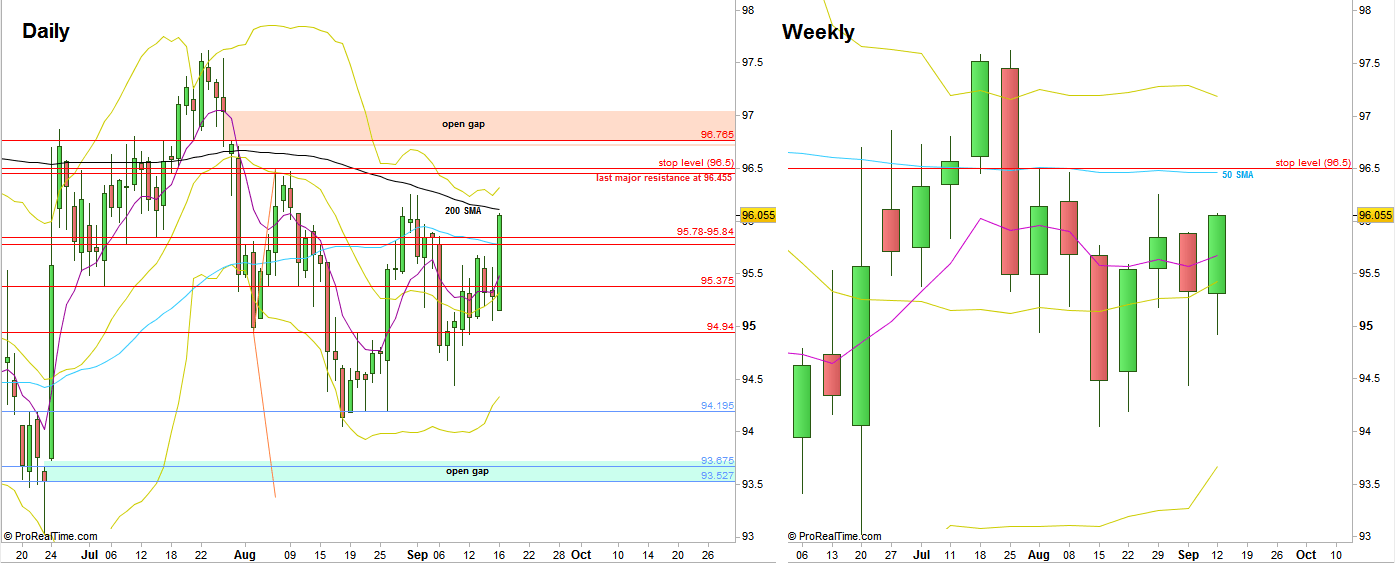

As expected, the consolidation in the current Weekly range is still under way.

The Dollar Index has still been showing strength on the upper side of that range, especially on last Friday. The Weekly High has been taken out. It would have been much more bullish had the price taken out the Weekly Low first.

We are still in an important junction as for the next midterm move. The real test is probably yet to come, testing again the Monthly High at 96.5. Taking out this High and making a follow through – mean that the whole price action since the Brexit decision was probably not a distribution, and the Dollar Index is most likely going to stay mostly in the mid Yearly range till the end of this year. Yet, by the price action seen on the bigger timeframes, this scenario is currently less likely to emerge.

The important barriers from above did not change, although their levels were. The Daily 200 SMA – pay attention how the price almost reached it by last Friday, but didn’t conquer it eventually after this big momentum up, the Weekly 50 SMA, currently at 96.45, and the Monthly 20 SMA which is at 96.6 – above the stop point level of the Monthly High (96.5).

Any bounce to test the Weekly 50 SMA, especially if taking out the Weekly swing High at 96.25, and which is followed by immediate sign of weakness, i.e. a Daily bearish pinbar that its High doesn’t take out the 96.5 level, and that closes below the Daily 200 SMA, is a good setup to go short – if a thrust down is made on the next daily bar.

Disclaimer: Anyone who takes action by this article does it at his own risk and understanding, and the writer won’t have any liability for any damages caused by this action.